“Money6X Real Estate” refers to a real estate investment strategy or platform that aims to significantly increase the returns on property investments. It typically involves leveraging financial tools, market analysis, and strategic property management to achieve substantial profit growth. This approach is designed for investors looking to maximize their returns in the real estate market.

Imagine turning every real estate investment into a powerhouse of profit with the revolutionary “Money6X Real Estate” strategy. This dynamic approach isn’t just about buying and selling properties—Money6X Real Estate about unlocking the full potential of your investments through advanced financial techniques and strategic market insights.

Picture transforming your real estate portfolio into a high-yielding machine that multiplies returns sixfold, all while navigating the market with precision and confidence. Whether you’re a seasoned investor or just starting out, “Money6X Real Estate” offers the key to exponentially boosting your earnings and achieving unparalleled financial success.

What is Money6X Real Estate?

Money6X Real Estate is a strategic investment approach designed to maximize returns on property investments. It employs advanced financial tools and market analysis to enhance profitability, aiming to multiply investment returns by six times. This method focuses on leveraging opportunities in the Money6X Real Estate market to achieve substantial financial growth.

By integrating cutting-edge strategies and insights, Money6X Real Estate offers a roadmap for investors to optimize their property portfolios. It caters to both seasoned professionals and newcomers, providing a systematic approach to navigating the market and capitalizing on high-yield opportunities.

Why Invest in Real Estate?

1. Financial Stability

Investing in real estate provides a steady stream of income through rental properties, offering reliable cash flow and financial stability. Unlike more volatile investments, real estate tends to appreciate over time, helping to secure long-term financial health and reduce overall risk.

2. Long-term Growth

Real estate investments often appreciate in value over the long term, making them a solid choice for those seeking growth. Property values generally increase with inflation and demand, allowing investors to build significant wealth and benefit from substantial capital gains.

3. Diversification of Portfolio

Including real estate in your investment portfolio helps diversify your assets, reducing risk and enhancing overall returns. Real estate often behaves differently from stocks and bonds, providing a hedge against market fluctuations and creating a balanced, resilient investment strategy.

The Benefits of Money6X Real Estate

| Benefit | Description |

| High Return on Investment | Money6X Real Estate strategies aim to significantly increase returns, often targeting a sixfold return on investments through strategic property management and market analysis. |

| Passive Income Opportunities | By Money6X investing in real estate properties, investors can generate a steady stream of rental income with minimal ongoing effort, leveraging property management services for passive earnings. |

| Tax Advantages | Money6X Real estate investments offer various tax benefits, such as deductions on mortgage interest, property taxes, and depreciation, which can reduce overall taxable income and enhance net returns. |

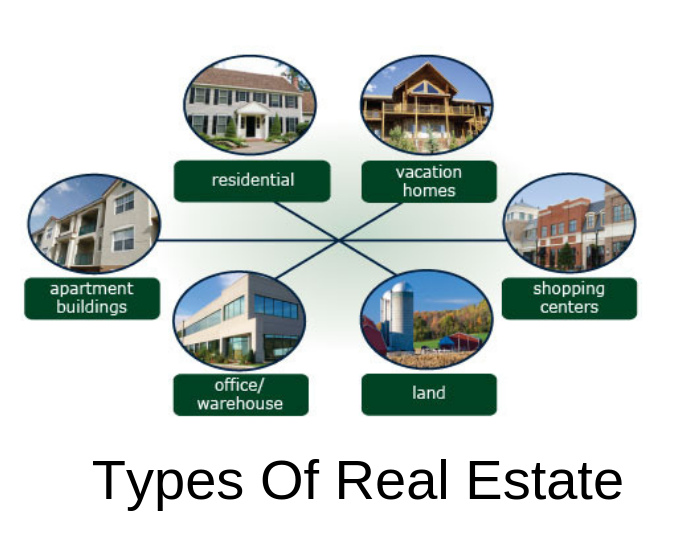

Types of Real Estate Investments

Residential Properties

“Residential properties include single-family homes, multi-family units, and apartment complexes. These investments focus on providing housing for individuals and families. They are often popular among investors due to their consistent demand and potential for stable rental income. Additionally, residential properties typically appreciate over time, offering long-term capital gains. For comparison, consider how residential investments contrast with the volatility seen in Crypto Bubbles, highlighting the stability and growth potential of real estate.”

Commercial Properties

Commercial real estate encompasses office buildings, retail spaces, and shopping centers. Investing in commercial properties can yield higher returns compared to residential real estate, as businesses often sign longer leases and provide stable cash flow. These properties can also offer opportunities for significant appreciation and value increase through strategic management and location selection.

Industrial Properties

Industrial properties include warehouses, manufacturing facilities, and distribution centers. These investments are driven by the demand for logistics and production spaces. Industrial real estate often features long-term leases with reliable tenants, providing a steady income stream. The growth of e-commerce has further boosted the demand for industrial spaces, making them a lucrative investment choice.

Land Investments

Land investments involve purchasing undeveloped land for future development or resale. This type of investment can offer significant returns, especially if the land is located in an area poised for growth or development. Land investments can be riskier due to market fluctuations and development challenges but can also yield substantial profits when strategically acquired and managed.

Getting Started with Money6X Real Estate

Initial Research

Before diving into Money6X Real Estate, thorough initial research is crucial. Begin by analyzing the real estate market trends, property values, and potential investment opportunities in your target area.

Understanding local market dynamics, such as demand for different property types and economic factors affecting real estate, will help you make informed decisions. Utilize resources such as market reports, property appraisal tools, and expert consultations to gather comprehensive data and identify high-potential investments.

Setting Investment Goals

Clearly defining your investment goals is essential for success in Money6X Real Estate. Establish what you aim to achieve, whether it’s generating steady rental income, maximizing capital gains, or diversifying your portfolio.

Set specific, measurable, achievable, relevant, and time-bound (SMART) goals to guide your investment strategy. This clarity will help you focus your efforts, allocate resources effectively, and track progress towards achieving substantial returns on your real estate investments.

Getting Started with Money6X Real Estate

Initial Research

Before diving into Money6X Real Estate, thorough initial research is crucial. Begin by analyzing the real estate market trends, property values, and potential investment opportunities in your target area.

Understanding local market dynamics, such as demand for different property types and economic factors affecting real estate, will help you make informed decisions. Utilize resources such as market reports, property appraisal tools, and expert consultations to gather comprehensive data and identify high-potential investments.

Setting Investment Goals

Clearly defining your investment goals is essential for success in Money6X Real Estate. Establish what you aim to achieve, whether it’s generating steady rental income, maximizing capital gains, or diversifying your portfolio.

Set specific, measurable, achievable, relevant, and time-bound (SMART) goals to guide your investment strategy. This clarity will help you focus your efforts, allocate resources effectively, and track progress towards achieving substantial returns on your real estate investments.

Understanding Market Trends

To successfully navigate the Money6X Real Estate strategy, it’s vital to grasp current market trends. This involves analyzing factors such as property value fluctuations, interest rates, and economic indicators that influence real estate dynamics. Monitoring trends in supply and demand.

Housing starts, and rental yields can provide valuable insights into the market’s health and potential investment opportunities. Staying updated with industry news and reports will help you anticipate shifts and make informed decisions to optimize your investment returns.

Understanding local market conditions is crucial. Each real estate market has unique characteristics influenced by regional economic conditions, population growth, and infrastructure developments.

By evaluating local trends and comparing them with broader market patterns, you can identify areas with high growth potential and tailor your investment strategy to leverage these opportunities effectively.

Financing Your Real Estate Investments

- Mortgage Options

- Traditional mortgages: Offered by banks or credit unions, typically requiring a down payment and offering fixed or adjustable interest rates.

- FHA loans: Government-backed loans with lower down payment requirements for qualifying buyers.

- Private Lending

- Hard money loans: Short-term loans provided by private investors or companies, often used for quick financing and higher-risk projects.

- Private investors: Individuals or groups who provide capital in exchange for equity or a return on investment.

- Crowdfunding

- Real estate crowdfunding platforms: Online platforms that pool funds from multiple investors to finance real estate projects, offering opportunities for smaller investments.

- Equity crowdfunding: Investors receive ownership shares in the property or project, potentially earning returns through property appreciation and rental income.

Key Strategies for Success

Buy and Hold

The Buy and Hold strategy involves purchasing property and holding it for an extended period to benefit from long-term appreciation and rental income. This approach capitalizes on property value growth over time and provides a steady cash flow from tenants, making it a stable investment for building wealth gradually.

Fix and Flip

Fix and Flip is a strategy where investors buy properties that need renovation, improve them, and then sell them for a profit. This method focuses on quick returns by adding value through upgrades and repairs, targeting short-term gains rather than long-term income.

Rental Properties

Investing in rental properties involves buying real estate to rent out to tenants. This strategy generates regular income from rents while also benefiting from potential property appreciation. It’s ideal for investors looking for steady cash flow and long-term value growth.

Real Estate Investment Trusts (REITs)

REITs are companies that own or finance income-producing real estate and offer shares to investors. This strategy allows individuals to invest in a diversified portfolio of properties without directly owning them, providing opportunities for regular dividends and potential capital appreciation with lower entry costs.

Market Analysis and Trends

- Current Market Conditions

- Property values: Assess recent trends in property prices and local real estate activity.

- Supply and demand: Analyze the balance between available properties and buyer interest to gauge market competitiveness.

- Future Projections

- Growth trends: Review forecasts for property value increases and anticipated market changes.

- Development plans: Consider upcoming infrastructure or development projects that may affect property values.

- Impact of Economic Factors

- Interest rates: Higher or lower interest rates can influence borrowing costs and property affordability.

- Employment rates: Job growth can drive demand for housing and affect rental markets.

- Inflation: Rising inflation can impact property prices and investment returns.

Risks and Challenges

| Risk/Challenge | Description |

| Market Volatility | Fluctuations in property values and rental income due to economic shifts, market demand changes, and unforeseen events. |

| Legal Issues | Potential legal complications such as zoning laws, property disputes, tenant rights, and compliance with local regulations. |

| Property Management | Challenges in maintaining property condition, managing tenants, handling repairs, and ensuring consistent rental income. |

Legal Considerations

Understanding Property Laws

It’s crucial to familiarize yourself with property laws to ensure compliance and avoid legal issues. These laws cover aspects such as property ownership, tenant rights, and landlord responsibilities. Knowing the legal framework helps you navigate the complexities of real estate transactions and property management effectively.

Zoning Regulations

Zoning regulations dictate how properties can be used and developed. They determine land use, building heights, and density restrictions, affecting what you can and cannot do with your property. Understanding these regulations is essential for ensuring that your investment aligns with local zoning requirements and avoiding potential legal conflicts.

Contract Essentials

Real estate contracts outline the terms and conditions of property transactions, including purchase agreements, lease agreements, and service contracts. Key elements include purchase price, closing date, contingencies, and responsibilities of each party. Ensuring that contracts are clear and comprehensive helps protect your interests and facilitates smooth transactions.

Finding the Right Properties

- Location Analysis

- Evaluate neighborhood quality, including safety, amenities, and proximity to schools and transportation.

- Research local market trends and growth potential to identify areas with high demand and future appreciation.

- Property Valuation

- Compare recent sales of similar properties (comps) to estimate fair market value.

- Consider property condition, size, and features to determine its investment potential and future resale value.

- Negotiation Tips

- Start with a lower offer and be prepared to negotiate to achieve a better purchase price.

- Understand the seller’s motivations and leverage market data to strengthen your negotiation position.

Conclusion

In conclusion, Money6X Real Estate offers a compelling strategy for maximizing returns on real estate investments through meticulous market analysis, strategic property management, and innovative financing options.

By focusing on high-return opportunities and leveraging financial tools, investors can significantly enhance their portfolios and achieve substantial growth. The key lies in thorough research, clear investment goals, and an understanding of the diverse real estate options available, from residential to commercial properties.

As with any investment strategy, success in Money6X Real Estate requires a careful balance of risk and reward. Staying informed about market trends, understanding legal considerations, and employing effective negotiation tactics are essential for navigating the real estate landscape.

By adopting a strategic approach and remaining adaptable, investors can unlock the full potential of their real estate ventures and achieve impressive financial outcomes.